Menu

Click on the State of Your Preference to Get Tax Deed Detailed Information

Click on the State of Your Preference to Get Tax Deed Detailed Information

Zoom level changed to 1

Alaska

Arkansas

California

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

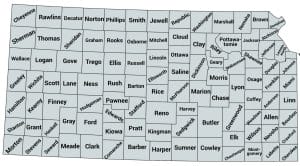

Kansas

Maine

Massachusetts

Michigan

Minnesota

Nevada

New Mexico

New York

North Carolina

North Dakota

Ohio

Oklahoma

Oregon

Pennsylvania

South Carolina

Tennessee

Texas

Utah

Virginia

Washington

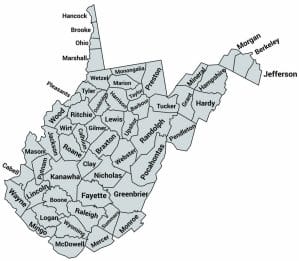

West Virginia

Wisconsin

Alaska

| Type: | Tax Deed |

| Bidding Process: | First Come First Serve Basis via Sealed Bid |

| Frequency: | Varies by Burrough Preferences |

| Interest Rate / Penalty: | N/A |

| Redemption Period: | N/A |

| Online Auction: | No |

| Over the Counter: | Yes |

| Statute: | Alaska Statutes 29.45 Sec 320 |

NOTES:

For people interested in owning property, and then using that to make a big profit, tax deed states like Alaska are the place to invest. “You may find that tax auctions can provide a nice source of income, a way to own land without spending a great deal of money, or just a way to pick up that property that adjoins yours. If you do succeed in finally acquiring title, it will most likely be because you did your homework and understood the appropriate laws and customs,” says an article at Homestead.org, a website for people who want to live as independently as possible. Neal Shelton, the article writer, offers plenty of solid advice for those interested in investing in a tax deed state.Arkansas

| Type: | Tax Deed |

| Bidding Process: | Premium |

| Frequency: | Annually Typically During Summer Months |

| Interest Rate / Penalty: | N/A |

| Redemption Period: | 30 Day Redemption Period & 90 Day Litigation Period |

| Online Auction: | No |

| Over the Counter: | Yes |

| Statute: | Arkansas Code Sec 26-37-101 |

NOTES:

Arkansas postponed the tax deed sales in 2020, which means many of the parcels in the 2021 sales have another year of taxes added to the total. As an investor, this is not something to concern you. When you buy in tax deed states, you get the property. In Arkansas, you get the property for a fraction of the real value. Looking over the list from the state tax office shows every county has something to sell. In Sebastian County, the property at 4610 N. 35th St., Ft. Smith, has a listed value of $64,050. The past-due taxes are $7,680, or a bit over 10% of the tax-assessed value. The real estate guide website Zillow puts the value at $85,000. Which is correct? Remember, tax assessors will often set the value a bit low to avoid being hauled into court to justify their number. Regardless, investing $7,680 to get a property worth at least $70,000 certainly leads to a big profit. Over in Perry County, 10 acres of farmland with another 2.5 acres of timber had past-due taxes of $435.08. It is worth about $2,000. Making this even better, standing timber prices are high right, making the trees a real value.California

| Type: | Tax Deed |

| Bidding Process: | Premium |

| Frequency: | Annually – Varies Throughout Year |

| Interest Rate / Penalty: | N/A |

| Redemption Period: | No but They Can Challenge Validity of Sale for 1 Year |

| Online Auction: | Yes – Most Counties |

| Over the Counter: | No – ‘ReOffer Sales’ Though |

| Statute: | Ca. Rev & Taxation Code Div 1 Part 6 |

NOTES:

The counties in some tax deed states keep a list of past sales. This is useful because you can see the prices for properties in past sales. You can make an educated guess about upcoming properties and what the selling price will be. Placer County, CA, keeps a list dating back several years. Looking at the list, the very first property in 2019 had an opening bid of $19,200. Remember, this is the past-due taxes and the late fees the tax office adds on. The official assessment is $35,528. The winning bid was $120,000. That does not make sense until you realize the assessment is the taxable value, not the real market value. So how much is the property actually worth? The real estate guide website Zillow says $625,000. Imagine buying a house for 1/6th of the real value. It happens in California!Connecticut

| Type: | Hybrid – Liens & Redeemable Deeds |

| Bidding Process: | Premium |

| Frequency: | Annually – Varies Throughout Year |

| Interest Rate / Penalty: | N/A |

| Redemption Period: | 1 Year With 18% Penalty |

| Online Auction: | No |

| Over the Counter: | No |

| Statute: | Connecticut Gen Stat Title 12 Ch 204 |

NOTES:

A lot of people look at tax deed states’ auctions and see undeveloped land. They give it a hard pass. Sometimes, that may be the right thing to do. Sometimes, that might NOT be the right thing to do. In Hartford, the City Council put an eye on several undeveloped tracts on the north edge of downtown. City officials reasoned if the City bought the property at the auction, they could use it for development. Hartford already owned some nearby parcels. If the City has genuine development plans for the area and can make it happen, property values in the area will go up. Investors and businesses will move in. This is an example of buying property in a tax sale and then selling it later, at a profit, to someone who wants to develop it. A purchase here should take a lot more research than usual. You need to know the City’s plans in detail. That will tell you if the property is worth buying.Delaware

| Type: | “Monition Sales” (Redeemable Deed) |

| Bidding Process: | Premium |

| Frequency: | Quarterly or Monthly Based on County |

| Interest Rate / Penalty: | N/A |

| Redemption Period: | 1 Year With 20% Interest or 60 Days With 15% Penalty, Determined by County |

| Online Auction: | No |

| Over the Counter: | No |

| Statute: | Delaware Statue Title 9 Ch 87 |

NOTES:

Watching the real estate news in tax deed states can be informative. It lets you know where the real estate market is booming and where it is not doing so well. Beach properties are almost always hot. Post-pandemic Delaware experienced a particularly large boom along the coastline. “Home sales in the Delaware and Maryland Eastern Shore beach communities saw a huge spike in 2020, and real estate agents and buyers alike say it was largely fueled by the pandemic, with buyers, many from the D.C. area, seeking a refuge away from the city but within driving distance of home,” says WTOP News. “The median price of a home listed for sale in Rehoboth Beach in 2020 was almost $600,000, a 15.1% increase from 2019…” Zillow says. Other reports say homes sales are climbing with homes selling for more than the listed price. As an investor, this means if you buy a house in a tax sale along the Delaware shoreline, you can expect to sell it quickly and for a big profit.Florida

| Type: | Hybrid – Both |

| Bidding Process: | Liens – Bid Down the Interest Rate. Deed – Premium |

| Frequency: | Throughout the Year Per County Discretion |

| Interest Rate / Penalty: | 18% |

| Redemption Period: | 2 Years |

| Online Auction: | Yes |

| Over the Counter: | Yes |

| Statute: | Florida Statutes Chapter 197 |

NOTES:

A banker from Saudi Arabi bought a condo in Orlando for $280,000. Twelve years later, the family did not pay the taxes and the home was sold to an investment company for $196,400. Given the Central Florida housing market, the condo is probably worth twice that. Anyway, the condo owner tried to get his property back and filed a lawsuit which was finally settled out of court and saw the owner pay $250,000 to get his condo back. The Orange County tax collector was tasked with defending the lawsuit. The report in the Orlando Sentinel says, “past auctions have sold off plenty of vacation homes but also a billboard, cell-phone tower and a private landfill.” Why someone would buy a private landfill is a question to ask someone else. Buying a cell phone tower, with a guaranteed monthly rent from cell phone companies, makes a lot of sense.Georgia

| Type: | Redeemable Deed |

| Bidding Process: | Premium |

| Frequency: | Monthly on First Tuesday on the Month in Most Counties |

| Interest Rate / Penalty: | N/A |

| Redemption Period: | 1 Year With 20% Penalty + 10% for Each Subsequent Year Until Foreclosure Is Filed |

| Online Auction: | No |

| Over the Counter: | No |

| Statute: | Georgia Code Title 48 Ch 4 Article 1 |

NOTES:

Bibb County and Macon launched an experimental Land Bank to try to move properties that do not sell in the regular tax deed auction. This is the first of its kind in the Peach State. In a land bank sale, the usual year-long redemption is cut to 60 days. Macon-Bibb County Land Bank always bids the amount of the past-due taxes and associated fees. If someone else bids, the Land Bank steps out of the auction. At a sale in April, 2021, the Land Bank bid $10,890.27 for a house at 379 Madison Street. The real estate guide Zillow says the house is worth $28,554. Since the Land Bank bought the house, it will turn it around for $2,500, getting the County government and School Board to write-off the past-due taxes. The buyer is expected to renovate the home. If someone had bid $10,890.28, the Land Bank would let them have the house. The buyer would get the property for about 1/3rd the real market value.Hawaii

| Type: | Redeemable Deed |

| Bidding Process: | Premium |

| Frequency: | Yearly – Varies County by County |

| Interest Rate / Penalty: | N/A |

| Redemption Period: | 1 Year With 1% Monthly Interest |

| Online Auction: | No |

| Over the Counter: | No |

| Statute: | Hawaii Const Art 8 Sec 3 Ch 246 |

NOTES:

Buying a lot in a tax sale on the only island state in the US may sound like a dream. As a tax deed state, Hawaii does offer plenty of lots for sale each year in its tax sale. Buying property here, especially on the “Big Island” of Hawaii underscores what Ted Thomas constantly says, “do your homework.” You must remember Hawaii is an island with active volcanos. That makes a difference. Some of the inland lots are in high-risk zones for lava. Other properties are a much better investment. Reporting on a past sale, the Honolulu Civil Beat online magazine said, “Most of the remaining lots and homes up for sale are in other Puna and Kau subdivisions, including Hawaiian Shores, Hawaiian Paradise Park, Kapoho Vacationland, Milolii Beach Lots and Hawaiian Beaches.” Those are prime locations for homes and are excellent places for a tax deed investor. If you plan to invest in Hawaii, take an additional step and use Google Earth to check out the property. You will be able to see where the property is and what the surrounding area looks like. If you see a lot of homes, it is probably a good buy. If you see a lot of lava fields, best to stay away.Idaho

| Type: | Tax Deed |

| Bidding Process: | Premium |

| Frequency: | Annually in May or Varied Based on Number of Properties |

| Interest Rate / Penalty: | N/A |

| Redemption Period: | N/A |

| Online Auction: | No |

| Over the Counter: | Only a Few Counties |

| Statute: | Idaho Code Sec 63-100 to 63-101 |

NOTES:

Idaho is a prime state for a tax deed investor looking for rental property to have a regular monthly income. The tax deed state has a housing shortage. The shortage is so bad in some places, tent cities are needed to house people who have jobs. This means buying property in the tax sale puts you in a position to become a landlord with an almost guaranteed monthly income. In Rexburg, the tax office set a sale for the property at 252 W 1st St, Rexburg, ID. Realtor.com puts an estimated value on this house of $285,000. Going into the tax sale, the opening bid was $789.60. If you bought this house, you could easily rent it for what that amount or more. Deals like the abound across Idaho.Kansas

| Type: | Tax Deed |

| Bidding Process: | Premium |

| Frequency: | Varies by County & as Needed Depending on Number of Properties |

| Interest Rate / Penalty: | N/A |

| Redemption Period: | N/A |

| Online Auction: | No |

| Over the Counter: | No |

| Statute: | Kansas Statute Article 21 Ch 79-2101 |

NOTES:

Some tax deed states like Kansas sell a redeemable tax deed. In Kansas City, that means big profits for people who invest in tax sales. The Associated Press took a look at some of these sales and found people are making big profits. One example mentioned in the story saw a home get sold for $2,300. When the property owner redeemed the house, it gave the buyer a big profit. “They eventually got their home back… The total was $5,200,” the news story stated. Over in Bourbon County, the tax collector prepared for a sale. The story in the Fort Scott News was the usual information about the sale, until the very end of the article. County Justin Meeks said the tax sale was dependant on title companies doing research on the properties for the auction. Then, he said something that should make investors take note. “They have been very busy, which is a good thing for everyone because that means houses are selling,” Meeks said. In other words, the real estate market there is hopping so selling a property you bought in the auction should happen quickly.Maine

| Type: | Tax Deed |

| Bidding Process: | Oral or Sealed Bid – Premium |

| Frequency: | Varies |

| Interest Rate / Penalty: | N/A |

| Redemption Period: | N/A |

| Online Auction: | No |

| Over the Counter: | No |

| Statute: | Maine Revised Statute Title 36 Part 2 |

NOTES:

As one of the tax deed states, Maine’s city and county governments take sealed bids to sell the tax-defaulted properties. In Blue Hill, one of the properties that recently went to the sale was 49 Sand Beach Lane. Talk about a value! The property is less than half a mile from the ocean and had a past-due tax bill of $8,585.46. The property was valued at $76,400 for tax purposes, so the real value is likely closer to $100,000. Regardless, this property would make an incredible vacation home. In Maine, the tax sales are usually ordered by the local elected council or board. In Millinocket, the council posts a notice about upcoming sales on the website. In May, 2021, 96 Aroostook Ave. went out for bid. The Council asked for a minimum of $5,538.23 for the property which the real estate guide Zillow says is worth $39,200.Massachusetts

| Type: | Tax Deed |

| Bidding Process: | Varies by Municipality |

| Frequency: | Varies |

| Interest Rate / Penalty: | N/A |

| Redemption Period: | 6 Months |

| Online Auction: | No |

| Over the Counter: | No |

| Statute: | Mass Gen Laws Part 1 Title 9 Ch 60 |

NOTES:

When the local media reports “big profits” in tax lien states, then you know you can make money by investing in tax lien states like Massachusetts. WGBH, the local public radio station, had a reporter do an investigation into tax lien sales across the state. While the article takes a dim view of the sale process, it does note these sales work and people make plenty of money. “Tax collectors are happy to recover all of the money they are owed, and investors can collect up to 16 percent interest from homeowners whose titles were sold off. If those property owners fail to pay back the debt, investors can sometimes reap big profits, foreclosing on the real estate in Land Court,” reported Chris Burrell. One of the people interviewed for the story said he lost four rental properties to a tax lien foreclosure. The winning bidder spent $1,052.84 to get one house. The house had a fair market value of $270,000. The owner fought the foreclosure and won, but had to pay the lien buyer $4,600. The buyer more than quadrupled his investment. Who had to pay for the court case? The City of Worcester had to defend the sale. The lien buyer just sat back and collected his big profit.Michigan

| Type: | Tax Deed |

| Bidding Process: | Premium |

| Frequency: | Annually Between July to Nov |

| Interest Rate / Penalty: | N/A |

| Redemption Period: | N/A |

| Online Auction: | Yes |

| Over the Counter: | Yes “Surplus” |

| Statute: | Michigan General Property Tax Public Act 206 of 1983 |

NOTES:

If you follow the news, you know Michigan was hit hard by the economic crunch, COVID-19 and other factors that hammered the housing market. What is important to remember, people there still need somewhere to live. In Detroit, for instance, the city announced plans in the Detroit Free Press to sell unoccupied property. Occupied homes will go on the market in 2020. As one of the tax deed states, Michigan has some real values right now. The newspaper story includes a picture of 15348 Ilene St. as an example of an empty home. A quick look at this picture shows the roof has fallen in. The real estate website Zillow says the home is worth about $60,000. In this case, Zillow is wrong. Other homes in the area, which are in good shape and occupied, sell for about that much. As Ted Thomas says, you must do your homework and learn as much as you can about the property. The house might be a good buy for someone who can spend the money to make repairs. Otherwise, look for a different property to buy.Minnesota

| Type: | Tax Deed |

| Bidding Process: | Premium |

| Frequency: | Varies on as Needed Basis |

| Interest Rate / Penalty: | N/A |

| Redemption Period: | N/A |

| Online Auction: | No |

| Over the Counter: | Yes |

| Statute: | 2016 Minnesota Statutes Chapter 282 |

NOTES:

In an unusual move, the county government in Pipestone County, MN, handed the tax deed for a property to the City of Pipestone for $1. As of the story in the Pipestone Star, the city was still deciding what to do with the home at 622 Third Ave SW. The real estate website Zillow says it is worth $57,666. Pictures show a home that appears to be in fair shape. Even though you missed the chance to buy that house, Pipestone County was listing more homes for sale. Minnesota is one of many tax deed states and Pipestone County sells homes every year. 840 Third Ave. SW, Edgerton, was one that went to the sale. Zillow says the attractive 4 BR, 1BA home is worth about $45,000, with a high value of $61,000. The opening bid was $500, a huge value even if it needed some work. Zillow’s pictures show a move-in ready home.Nevada

| Type: | Tax Deed |

| Bidding Process: | Premium |

| Frequency: | Annually – Varies Throughout Year |

| Interest Rate / Penalty: | N/A |

| Redemption Period: | N/A |

| Online Auction: | Only Pershing County |

| Over the Counter: | No |

| Statute: | Nevada Revised Statute 361.585 |

NOTES:

When most people think of Nevada, they think of Las Vegas, gambling and the awesome shows at the casinos on The Strip. Casinos are there to take your money. Instead of leaving money, be a smart investor and make money since Nevada is one of the tax deed states. Washoe County lists its upcoming sales on the county website. You can even invest in Clark County where Las Vegas is located. For instance, the condo at 405 Paradise Pkwy # 3101 in Mesquite (Clark County has several cities other than Vegas) sold in 2019 for $94,000. The county tax office posted it for sale at $10,813.83, about 1/10th of the real value. Mesquite is not far from Vegas and this would make an excellent rental property, a vacation home or both. Rent it most of the year and reserve time for you and your family during the year. The real estate guide website Zillow has pictures of the inside and outside. Several home lots in Boulder City went on the block for more than $100,000. Why so much? Boulder City has some of the tightest regulations for building a home in the nation and limits the number of building permits each year.New Mexico

| Type: | Tax Deed |

| Bidding Process: | Premium |

| Frequency: | Annually Throughout the Year |

| Interest Rate / Penalty: | N/A |

| Redemption Period: | N/A |

| Online Auction: | No |

| Over the Counter: | No |

| Statute: | New Mexico Statutes Chapter 7 Article 38 |

NOTES:

A tax sale in Quay County, NM, sometime back proves why doing your homework is a vital part of investing in tax deed states like New Mexico. The Quay County Sun talked to several people who bought property in the auction. “John Cullum had just spent $400 for some land, but he wasn’t sure exactly what he had bought. Cullum and the Quay County Clerk hunted Thursday through county plat books to see just where the properties were.” That kind of tax deed investing is not responsible. You need to know what you are buying. Mr. Cullum did not do his homework and so bought something where he could lose everything he spent. The Sun’s article also makes the need for doing your homework very clear. “However, one commercial property they (two other investors) investigated had about $110,000 in liens, and bidders steered clear of that one.” Bidders were also told they needed to do their homework. “Gregory Allyassin, auctioneer and senior title examiner with the state’s Delinquent Property Tax Bureau… cautioned buyers before the bidding that they would be responsible for liens on properties, including those from the IRS,” the story said.New York

| Type: | Hybrid – Both |

| Bidding Process: | Premium on Deeds |

| Frequency: | Annually – Varies Throughout Year |

| Interest Rate / Penalty: | 20% on Liens With Bid Down |

| Redemption Period: | N/A |

| Online Auction: | Yes |

| Over the Counter: | No |

| Statute: | New York Real Property Tax Law Art 11 |

NOTES:

If you read the news about tax lien sales in the Empire State, you know New York City is having issues moving forward with a tax sale. The rest of the state is not having those problems. The rest of the tax lien states are also not having these problems. Floral Park in Nassau County set a sale for mid-May, 2021. Some of the properties in that sale were real deals. A house at 145 Emerson Ave., had past-due taxes of $3,740.85. Looking at the real estate website Zillow, you can see the home is worth around $1 million. The same tax liens sale listing had the most expensive tax lien as $9,235.98 for 6 Raff Ave. That is a duplex with an estimated value of $1 million. The property at 111 Iris Avenue had a listed sale price of $4,896.82. Zillow says it is worth about $720,000. When you look at how much these owners owe and compare that to value of the property, you can almost guarantee the owners will redeem the taxes. If they do not redeem, which is very rare, you can foreclose and own a home that is worth many times more than what you invested. That is a win any way you look at it.North Carolina

| Type: | Tax Deed |

| Bidding Process: | Multiple Step Process. 1) Tax Foreclosure Sale With Premium Bidding but 10 Day “Upset Bid” Period. Then Subsequent Sale Then Surplus |

| Frequency: | Annually – Varies Throughout Year |

| Interest Rate / Penalty: | N/A |

| Redemption Period: | N/A |

| Online Auction: | No |

| Over the Counter: | Yes – “Surplus” |

| Statute: | North Carolina General Statutes 105-374 |

NOTES:

Would you pay about $6,000 to get a $500,000 home in excellent condition? Well, a smart person says, “I need more information.” How about getting that home without a mortgage, owning it completely for that $6,000? A smart person will still say more information is needed. Over in Cumberland County, NC, a tax deed sale listed a $500,000 home for sale for about $6,000. North Carolina is one of many tax deed states. The house is 4715 Flintcastle Rd, Fayetteville. It was listed in the Cumberland County tax sale. The real estate website Zillow says the 3 BR, 2.75 BA home is worth about $500,000. The tax office says the property is worth $375,000. Remember tax assessors will put their value a bit under what the market value is to avoid being sued for over-valuing a home. The Cumberland tax sale had properties listed for as little as $4.96. The entire list had 5,589 properties.North Dakota

| Type: | Tax Deed |

| Bidding Process: | Premium |

| Frequency: | Annually on Third Tues in Nov |

| Interest Rate / Penalty: | N/A |

| Redemption Period: | N/A |

| Online Auction: | No |

| Over the Counter: | Yes on County Basis |

NOTES:

North Dakota recently changed its tax deed sale system to prevent the tax collector from keeping an over-bid on a tax sale property. As an investor in tax deed states, you need to know this does not affect how you bid or how much you bid at an auction. If you bid more than the opening amount, the former property owner gets the excess. The Pacific Legal Foundation, which opposes tax sales but does not suggest how counties will collect property taxes otherwise, reported on the case of the Juhl family. Their property taxes run about $575 a year and they did not pay their taxes for several years. Their house was taken. The Juhls settled with the county “by paying their debt, plus penalties and interest.” As an investor, you need to know the Juhl family had to pay interest, which is one of the ways you make a big profit by investing in tax sales.Ohio

| Type: | Hybrid – Both |

| Bidding Process: | Premium on Deeds |

| Frequency: | Annually Throughout the Year |

| Interest Rate / Penalty: | 18% With Bid Down |

| Redemption Period: | 1 Year on Liens but Not Targeted for Individual Buyers |

| Online Auction: | No |

| Over the Counter: | No |

| Statute: | Ohio Revised Code Section 5721.30 |

NOTES:

Ohio is one of the tax deed states but refers to the auction as a Sheriff’s sale. The name does not matter since the process is the same. You can make a big profit there. For instance, in Stark County, the May 2021 sale had 25 properties go to the auction block. Some sold, some did not. One property that did not sell is 3117 Millvale Ave. N.E. in Canton. The opening bid was $14,475.81. A look at the house on Realtor.com shows it needs a little work. Realtor.com says it is worth $76,100. A little work does not mean this is a bad investment, especially for less than $15,000. You could do the work, hire someone to do the work or sell the house at a profit below the market value and let the new owner take care of the repairs.Oklahoma

| Type: | Tax Deed |

| Bidding Process: | Premium |

| Frequency: | Annually in June |

| Interest Rate / Penalty: | N/A |

| Redemption Period: | N/A |

| Online Auction: | No |

| Over the Counter: | Yes but County by County |

| Statute: | Oklahoma Statutes Title 68, Sec 3000 |

NOTES:

In tax deed states, you can buy more than just homes. You can buy entire apartment buildings. In Oklahoma County, the apartments at 420 NW 8TH St., Edmond went into the sale with a tax debt of $5,853.32. The County’s sale notice did not have the address. Using the parcel number and the Oklahoma County tax assessor’s parcel viewer webpage, the physical address was found. The assessor says the market value of the property is $373,285. So what is the real value of the property? The real estate website Trulia says the 10,000 square foot 3-story building sold in 2007 for $400,000. That apartment building is an apartment neighborhood just off downtown and minutes from a hospital. A $6,000 investment could reap big profits here.Oregon

| Type: | Tax Deed |

| Bidding Process: | Premium |

| Frequency: | Annually in Spring or Summer |

| Interest Rate / Penalty: | N/A |

| Redemption Period: | N/A |

| Online Auction: | No |

| Over the Counter: | No |

| Statute: | Oregon Statutes Chapter 312 |

NOTES:

A recent tax sale in Jackson County, Oregon, saw seven properties go on the auction block. Three were no sales and four sold. The most expensive property went for $160,000 and the cheapest for $1,500 for a small lot. The $160,000 property had an opening bid of $100,000. This was 192 acres of land. It was valued at $457,570. The house at 683 Ross Lane, Medford, did not sell. This one is pretty understandable. The tax collector wanted $250,000 for the home with a value of $170,380. Realtor.com says the house is worth $331,000. Obviously, this house merits a lot more investigation before buying it.Pennsylvania

| Type: | Tax Deed |

| Bidding Process: | “Upset Sale” First With Premium Bidding Which Does Not Extinguish Other Liens, Followed by “Judicial Sale” Where All Liens With the Exception of Irs Liens Are Extinguished |

| Frequency: | Annually Throughout the Year. Upset Sales Typically Held in the Fall. Judicial Sale Typically in the Spring but Could Be Anytime After the Upset Sale. |

| Interest Rate / Penalty: | N/A |

| Redemption Period: | N/A |

| Online Auction: | Very Few |

| Over the Counter: | Yes Through “Repository” List With County Acceptance |

| Statute: | Pennsylvania Statutes Title 72-5860 |

NOTES:

When you invest in a Pennsylvania tax sale, you are making a secure investment. An Erie County judge et aside a tax sale for a Lake Erie beach house because the tax collector “failed to give personal notice” to the owner. If you are a tax deed states investor, that ruling might make you nervous. It should not. The person who bought the house in the tax sale got his money back. The buyer paid $76,000 for the $372,000 home. How many other investments will return your investment if things go wrong? If you buy stocks and the stocks crash, you lose money. In a tax sale overturned by a court like this, which is extremely rare and happens only once or twice a year across the entire United States, the investor ways gets his money back. Also, the county tax office is tasked with defending the sale.South Carolina

| Type: | Redeemable Deed |

| Bidding Process: | Premium |

| Frequency: | Annually in Fall |

| Interest Rate / Penalty: | 3% Per Quarter Capped at 12% Annually |

| Redemption Period: | 1 Year |

| Online Auction: | No |

| Over the Counter: | No |

County Map

NOTES:

Tax lien investors are carefully watching a South Carolina Supreme Court case on liens. The case, Mercury Funding, LLC, v. Beaufort County Tax Collector Kimberly Chesney, does not argue whether tax lien sales are legal. Rather, this case argues the legality of a S. Carolina law that extended the redemption period to two years for 2019 sales (the sale was held in 2020) only. This case only affects S. Carolina, not other tax lien states. This is important because it gives a homeowner another 12 months to redeem the property. As an investor, this is only concerning because your money is tied up for two years instead of one. You still earn the interest on your investment. In some states, the redemption period is even longer. If you bought a property in S. Carolina in 2019, make sure you pay the 2020 taxes. You get to collect interest on those as well. Tax lien sales are legal. No one in the lawsuit is arguing that. The U.S. Supreme Court has repeatedly held such sales are the last resort to collect needed property taxes.Tennessee

| Type: | Redeemable Deed |

| Bidding Process: | Premium |

| Frequency: | Vary Throughout the Year |

| Interest Rate / Penalty: | 12% |

| Redemption Period: | Up to 1 Year |

| Online Auction: | Very Few |

| Over the Counter: | Some Counties Yes, Others Do “Surplus Property Sales” After Redemption Period |

NOTES:

The Daily News Journal reports Rutherford County, TN, has a booming real estate market. Job growth, a small town feel and a low cost of living are driving the boom. As a tax deed states investor, that means you can easily flip a house you buy in a tax sale. The public notices in the Mufreesboro Post list 104 Nora Peebles Ln, Smyrna, in the sales notices. The real estate website Zillow describes it as a small home in a largely undeveloped neighborhood. In what sounds incredible, the house’s value is $157,143. Realtor.com agrees with that price tag. A hot housing market indeed!Texas

| Type: | Redeemable Deed |

| Bidding Process: | Premium |

| Frequency: | Monthly on First Tuesday of the Month |

| Interest Rate / Penalty: | 25% Penalty Per 6 Months for Non Homestead or Special Land Use Properties. If 2 Yr Redemption Period Applies 25% for 1st Year and 50% Penalty for 2nd Year |

| Redemption Period: | 6 Months for Most Properties. 2 Years for Homestead and Special Land Use Properties |

| Online Auction: | The Vast Majority No but in 2019 Two Counties (Victoria & Orange) |

| Over the Counter: | Sealed Bid for “Struck Off” Properties |

| Statute: | Texas Tax Code 1-E-24A |

NOTES:

As one of the tax deed states, Texas is a top state for tax deed investors. The state sells a redeemable deed and put a very high premium on that deed for the homeowner. The March sale had 29 properties going into the auction. Twelve sold and the rest were withdrawn. In Tarrant County, one recent sale was a home, 703 St. Eric Drive, Mansfield. The real estate guide Zillow says the 3,500 square foot home has a value of $400,000. The 2020 taxes were a bit under $400. The county does not post the sale amount online.Utah

| Type: | Tax Deed |

| Bidding Process: | Premium |

| Frequency: | Annually in May |

| Interest Rate / Penalty: | N/A |

| Redemption Period: | N/A |

| Online Auction: | No |

| Over the Counter: | No |

County Map

NOTES:

Tax deed states investors saw some good news coming out of Utah recently. The Salt Lake County tax office is moving to an online auction. This means you can live anywhere in the world and bid in the tax sale. The county contracted in mid-May 2021 with Bid4Assets.com to handle the online sale. The news story in Utah Business said the first-ever online auction was “no reserve meaning the highest bid at or above the minimum will win the property. Minimum bids will vary greatly ranging from $27 to $130,301.” Scott Tingley, Salt Lake County Auditor, said he expects taking the sale online will mean more bidders and properties will be more likely to sell.Virginia

| Type: | Tax Deed |

| Bidding Process: | Premium |

| Frequency: | Annually – Varies Throughout Year |

| Interest Rate / Penalty: | N/A |

| Redemption Period: | N/A |

| Online Auction: | No |

| Over the Counter: | No |

| Statute: | Code of Virginia 58.1-3965 |

NOTES:

Augusta County, Virginia, keeps a running list of past-due property taxes. As one of the tax deed states, the county holds regular sales to collect those past-due taxes by selling the property. A recent look at the list of properties there ran to 33 pages. While not all of these properties will go to the sale, many will. One of these properties, 42 Paine Run Rd, Grottoes, has past-due taxes of $9,884.66 as if this writing. The tax assessor puts the value at $33,000. The real estate website Zillow agrees, posting the exact same price. Given the amount of taxes owed, this is likely a multi-year default on taxes and the house will probably go into the next sale.Washington

| Type: | Tax Deed |

| Bidding Process: | Premium |

| Frequency: | Annually Later in the Year |

| Interest Rate / Penalty: | N/A |

| Redemption Period: | N/A |

| Online Auction: | Many |

| Over the Counter: | No |

| Statute: | Washington State RCW 84.64 |

NOTES:

You can buy more than homes in a tax deed sale. Washington is one of many tax deed states and sells undeveloped lots as some of the county sales. A recent sale in Thurston County saw several vacant lots go on the auction block. Some of these were waterfront lots, which command a premium price. 3404 93rd Ave SW, Olympia, sold for $165,200. The opening bid was $11,525.56. The real estate website Zillow estimates the bare lot is worth $201,192. Similar lots in the same neighborhood are selling for about that. Waterfront property is in high demand everywhere. No doubt this investor is going to realize a big profit soon, unless the buyer decides to build a home on the lot for himself.West Virginia

| Type: | Hybrid – Both |

| Bidding Process: | Premium |

| Frequency: | Lien Sales Annually Oct – Nov. Deed Sales Are Held on as Needed Basis and Only on Properties That Were Not Sold at Lien Sale and Were Held by the County for 18 Months |

| Interest Rate / Penalty: | 12% on Liens |

| Redemption Period: | 18 Months on Liens |

| Online Auction: | No |

| Over the Counter: | No |

| Statute: | West Virginia Code 11a Article 3 |

NOTES:

Looking at the West Virginia tax lien sales provides a good example of why doing your homework is vital to your success as an investor. West Virginia University’s College of Law took a look at the process and what it means to the owner, the investor and the community trying to collect back taxes. This is specific to the Mountain State and does not apply to other tax lien states.

The article emphasizes the point Ted Thomas makes over and over – Do your homework. WVU’s report notes some properties that go into the tax sale each year are abandoned or in poor condition. Such property can be a good investment, but you must do the research to find out if you can make money on it. Abandoned property can often be sold to a neighbor so that person can expand their yard. Downtown commercial property can be renovated and sold or rented.

West Virginia News reports on a good example of why renovation and rehab properties are good idea. “Community leaders in Wheeling and throughout West Virginia are applauding the state’s recent decision to make permanent the 25% historic rehabilitation tax credits, and officials predict it will spur future development in historic neighborhoods. In 2018, the West Virginia Legislature temporarily boosted the state’s historic rehabilitation tax credit from 10% to 25%. That beneficial bump was set to expire in 2022, but in light of the tremendous success and feedback, state officials removed that sunset date during the most recent legislative session.”

Wisconsin

| Type: | Tax Deed |

| Bidding Process: | Premium |

| Frequency: | Varies as Needed |

| Interest Rate / Penalty: | N/A |

| Redemption Period: | N/A |

| Online Auction: | No |

| Over the Counter: | No |

| Statute: | Wisconsin State Statutes Sec 75.69 |

NOTES:

As one of the tax deed states, Wisconsin sells property at the estimated market value in its sales. You must remember, the tax assessor is going to value the house below the true market value in order to avoid being sued for over-estimating the home’s value. This means you can find some deals in Wisconsin if you pay attention. A good example is in Dane County. In a recent listing, the tax collector put 2202 Lake Point Drive, Madison, into the sale. The county asked for $135,000. The real estate guide Zillow says that is about half price. Zillow says the home is worth $236,113.is proudly powered by WordPress